Jayant Agro Organics as per Annual Report March 2012: (Link to Annual Report March 2012)

Consolidated Export Incentives Receiveable: 254,631,185 (25.46Cr) (Page 70)

We all know that reported Consolidated Net Profit by Jayant agro for year ended March 2012: 313,521,057 (31.35Cr).. with export incentives of 25.46Cr I think the profits seem too low..

Lets try and follow the trail of Export Incentives and see if we can link the pieces together.

Page 60 of the March 2012 Annual report states:

"Turnover includes Sale of Goods, Services, Scrap, Export Incentives and are net of sales tax/Value Added Tax and Excise Duty."

Turnover is also known as Topline, Sales and part of Income statement

Lets go and look at the detailed Turnover data provided in the March 2012 Annual Report (Profit Loss/Income statement):

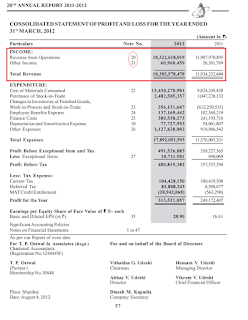

Page 57: Consolidated Statement of Profit and Loss for the Year Ended March 2012.

We can see :

Revenue from Operations: 18,322,618,019 (1,832.26Cr)

Other Income: 60,960,459 (6.09Cr)

This is high level and no break up for revenue is provided.. lets look at the notes 20,21 where we should get detailed info.. and the export incentive as mentioned in revenue recognition statement.

--------------------------------------

Looking at the detailed breakup of Revenue from Operations and Other Income as mentioned in Note 20 and 21 of Annual Report March 2012

There is a line Item for Foreign Exchange Gain, Power Generation Income, Interest Income, Dividend income, Refund of duties and claims.. all these line items detailed in the Revenue from Operations (Note 20) and Other Income (Note 21) of value less than Export Incentive (25.46Cr)

Surprisingly 25.46Cr worth of export incentives are not identified as a separate Line Item in the Revenue Section when.. its stated that Revenue/Turnover Includes Export Incentives.

-----------------------------

Question is Where are the export incentives.. how did I get that number 25.46Cr

Page 70 Note 19.

Export Incentive Receivable: 254,631,185 (25.46Cr)

Export Incentives are entered as a Receivable and hence entered as "Other Current Assets" which get added into the Balance Sheet and completely skipped out of the Income (Profit Loss) statement.

Also a careful observation worth mentioning

Export Incentive Receivable 2012: 254,631,185 (25.46Cr)

Export Incentive Receivable 2011: 271,772,800 (27.17Cr)

Page 73 Annual Report March 2012:

FOB Value of Export 2012 : 14,690,215,918 (1469.02Cr)

FOB Value of Export 2011 : 8,835,132,460 (883.51Cr)

FOB Export value has increased from 2011 to 2012 by 66.27% while the Export incentive receivable has reduced from 27.17Cr (2011) to 25.46Cr (2012) a reduction of 6.2% in export incentive receivable.

My understanding..

"Export Incentive receivable" is lower as its most likely a Quarterly/half yearly figure and not a full year figure.

Since Balance Sheet is prepared as of 31 March the last Quarterly/halfyearly payment is still due and hence a "receivable" ...

So the question is "What is the Full Year Export Incentive"

Why its missing from the Income statement while other small line items which are of lesser value mentioned in the Income statement?

- Export Incentives are missing from the Income statement .. though they are mentioned as part of balance sheet.

- "Export Incentive Receivable" is a subset of the Total Export Incentive received in a year because Export Incentive should have increased by same amount as increase in exports (Year on Year)

What should be the impact on bottomline of export incentive.

Case1:

Net Profit Reported for March 2012: 31.35Cr

Export Incentive Receivable not included in Income statement: 25.46Cr (assuming this as full year export incentive)

Hypothetical Net Profit for March 2012: 31.35+ 25.46 = 56.81Cr

--------------------

Case 2:

Now if we consider that with a 66.27% increase in exports over 2011 actual export incentives should have also increased by 66.27% over 2011.

2011 Export Incentive: 27.17Cr (assuming this is full year export incentive)

Hypothetical Export Incentive 2012 (66.27% higher than 2011): 45.17Cr

Hypothetical Net Profit (with increased export incentive): 45.17Cr + 31.35 = 76.52Cr

--------------------

Conclusion: Jayant Agro Organics Reported Net Profit for March 2012: 31.35Cr on sales of 1832.26Cr which is 1.71% of its sales. a very low figure making the business an unattractive investment. Reading through the Annual Report for March 2012 we observe that Export Incentive Receivable is worth 25.46Cr and not included in the Income statement of Jayant Agro Organics.

Another observation is that in 2012 Export sales have increased by 66.27% while reported Export incentives have fallen .. which is again an anomaly

A hypothetical Net Profit number based on two conditions bring us to a Hypothetical Net Profit of: 56.81Cr and 76.52Cr which then translates to a Net Profit margin of: 3.10% and 4.1% (realistic figure)

The other point is when Net Profit was 31.35Cr PBDIT was 88.88Cr with hypothetical Net Profit range of 56.81 to 76.52Cr .. PBDIT range is: 114.34Cr to 134.05Cr .. Now Current Market Cap of Jayant is just 144Cr (CMP: 96.20) .. So right now Jayant is hypothetically quoting at close to 1 times hypothetical PBDIT.. and hence Very Very Cheap.. These are based on Export Incentive Receivable.. not actual export incentives Received (which is not provided in Annual Report March 2012) so still represent a conservative estimate of PBDIT and Net Profit.

Please Note: I am not a Chartered Accountant or a CFA (Chartered Financial Analyst) or an Accounts Graduate. I am an engineer by profession and these numbers stated are my understanding of "Publicly available" information. I donot claim them to be accurate .. Its my understanding of what I think it should be..

Anyone who can provide more insight .. please feel free to value add.. Those who are not invested should also invest as these are extremely low prices for Jayant Agro Organics (Below Rs100 per share)

Most Important... Please do your own deep dive before investing..

4 comments:

WhatsUP Ji,

Interesting analysis.

I think Export Incentives are not paid in cash by Govt to exporting companies. I think these incentives can be used in IMPORTS (import duty - export incentives).

ICAI treats these in AS-9 (Accounting Standard 9) on Revenue Recognition.

Question is: does JAOL intends to import stuff? It could be capital goods or raw material.

Anonymous ji:

in 2008-9 jayant was reporting export incentives.. as well as sale of import licenses..

all this was part of other income.. and reported as a line item..

the question is ..

1. do you think there is under reporting?.. (since you seem to be from the same field..and more knowledgeable..)

2. how do we proceed with getting this addressed by the Jayant Agro Management..

=happy investing

whatsup-indianstockideas.blogspot.com

WhatsUP Ji,

Indeed I do come from accounting background but that was some 25 years back. I am more of Systems guy now.

I think one can raise a query to the Company Secretary asking for clarification on accounting treatment of Export Incentives.

The funny thing about accounting is, for every credit, there is a corresponding debit. If the figure appears in current assets (a debit), where is the corresponding credit? It has to be buried somewhere in income.

Cheers

Anonymous ji:

Thanks for your input..

With regards to export incentives.. Govt gives.. export credit 2% discount.. (that's one reason I think debt is increasing with sales(exports) just to capture the 2% discount on export credit..

-----------------

The various schemes are:-

1. EPCG (Export Promotion Capital Goods)

2. DFIA (Duty Free Import authorization)

3. DEPB (Duty Entitlement Pass Book)

4. Advance Authorization Scheme

5. VKGUY(Vishesh Krishi Gram Udyog Yojna)

6. Focus Market Scheme (FMS)

7. Focus Product Scheme (FPS)

-------------

Jayant exports most of its products under FMS,FPS and VKGUY .. where the Duty credit script is 2-5% of FOB Value.. at 1469cr FOB exports in March 2012 thats, in the range 29.38cr to 73.45cr

-------------

So basically all the Net profits reported is just the duty credit that Jayant gets from govt.. actual profits are " " invisible..

----------------

=happy investing

whatsup-indianstockideas

Post a Comment