Current Market Price: 107.20.

Market Cap: 160cr

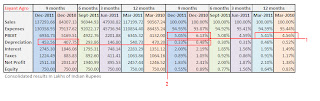

Sales 9 months ending Dec 2011: 1372.93cr

PBDIT 9 months ending Dec 2011: 69.34cr

Taxes 9 months ending Dec 2011: 12.24cr

Net Profit 9 months ended Dec 2011: 25.11cr

EPS 9 months ended Dec 2011: 16.74

Promoters of Jayant Agro Organics as per disclosure norms set by SEBI have bought from the Open market (Public) 5,60,346 shares from the open market.

Total Cost of acquisition of 5.6 lakh shares is Rs 6.5Cr Avg price per share is: 116.27

Other interesting fact is .. all these shares were bought from one broker as intermediary:

Ved Brothers Securities Pvt Limited.

In Dec 2011 Results for 9 months:

Taxes Paid 9 months ending Dec 2011: 12.24Cr

Taxes Paid year ending March 2011: 10.63Cr

Net Profit 9 months ending Dec 2011: 25.11Cr

Net Profit year ending March 2011: 24.57Cr

So looks like profits have been kept suppressed and ideally we should have seen around 28.28Cr as net profit for 9 months ending Dec 2011(considering 30.21% income tax rate of March 2011)

Conclusion: In past 24 days 5.6 lakh shares have been bought by promoters spending 6.5Cr in cash at an avg share price of 116.27. Tax payments are also high. Sebacic Acid derivatives plant has also started commercial production.

Castor oil and its derivatives are used in toothbrush bristles, medical disposables like feeding tubes, IV fluid, deodorant, shaving cream, aftershave,soap shampoo, perfumes, cosmetics, Textile dyes, Bread, chocolate, icecream, autoparts, lubricants, engine coolants, fuel additives, marine paints, engineering plastics, pencil, writing inks, paper, crayons, mobiles, laptop, telecommunications and furniture

Things have started to move and going forward ..we could see sharp price increases. Strong Buy!!

In Dec 2011 Results for 9 months:

Taxes Paid 9 months ending Dec 2011: 12.24Cr

Taxes Paid year ending March 2011: 10.63Cr

Net Profit 9 months ending Dec 2011: 25.11Cr

Net Profit year ending March 2011: 24.57Cr

So looks like profits have been kept suppressed and ideally we should have seen around 28.28Cr as net profit for 9 months ending Dec 2011(considering 30.21% income tax rate of March 2011)

Conclusion: In past 24 days 5.6 lakh shares have been bought by promoters spending 6.5Cr in cash at an avg share price of 116.27. Tax payments are also high. Sebacic Acid derivatives plant has also started commercial production.

Castor oil and its derivatives are used in toothbrush bristles, medical disposables like feeding tubes, IV fluid, deodorant, shaving cream, aftershave,soap shampoo, perfumes, cosmetics, Textile dyes, Bread, chocolate, icecream, autoparts, lubricants, engine coolants, fuel additives, marine paints, engineering plastics, pencil, writing inks, paper, crayons, mobiles, laptop, telecommunications and furniture

Things have started to move and going forward ..we could see sharp price increases. Strong Buy!!

2 comments:

check this url..

There had been a big sell of 274000

on FEB 1.. I belive since many are selling jayant promoters are buying in just to make sure stock does not fall...

http://www.moneycontrol.com/stocks/marketstats/blockdeals_query.php?sc_id=JAO&post_flg=1&myexchg=Both#JAO

Purushottam:

Promoters were the buyers and ANAND KAMALNAYAN PANDIT was the seller.

It cannot be an attempt to support the stock price.. because this deal was done at the new 52 week high price.. (124)

On jan 2,2012 Jayant agro closing price was 81.10

block Sell price of 124/= is 53% higher than the price of jayant at beginning of Jan 2012..

I would say it was an offer to buy a large chunk of shares.. and the promoters took that offer .. the stock was accumulated by the intermediary (ved brothers) at the trigger price ANAND KAMALNAYAN PANDIT sold to promoters..

Ved brothers is now also selling all the excess jayant stock it had accumulated to reach the trigger price of 124 to promoters..

In fact total buying of shares by promoters is close to 5.9 lakh shares(past 30 days) which is more than double the amount of shares sold at 52 week high price..

==================

Personally Purushottam.. I think its the promoters who are buying as some good news flow is going to happen..

==================

look at gael where promoters bought at 18-19 levels (close to lowest point of gael stock price.. which looks like a support attempt)

Jayant promoters buy price is close to new 52 week high .. so definitely its not a buying to support stock price..

==================

If you have exited.. its still a great price (107-109) to get into jayant .. ideally jayant should have a market cap close to one times sales .. thats a 10x from these levels..

=================

(I am not recommending sell GAEL and buy jayant.. I have maintained both my stock levels..) and might buy more jayant going forward..

=happy investing

whatsup-indianstockideas.blogspot.com

Post a Comment